Table of Contents

Editor’s note: Seeking Alpha is proud to welcome Penny Stocks Today as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Solskin

Clover Health Investments Corp (NASDAQ: CLOV) is a health care company which provides Medicare Advantage insurance plans and operates as a direct contracting entity with the U.S. government. The company is also a self-described “physician enablement company” due to its healthcare technology, the Clover Assistant, which is the main differentiator between Clover and similar healthcare companies.

CLOV is now down 76% from its 52-week high of $11.13. At this price, CLOV is a buy based on its QoQ revenue and membership growth. For long-term investors it offers additional value based on the healthcare technology landscape. In this article I will outline why I am bullish on Clover’s long-term growth as well as the levels I’m watching for the company’s Q2 earnings in August.

Overview

My thesis for long-term investment in Clover is based on the value the Clover Assistant presents in the current healthcare technology landscape. This technology has evolved rapidly over the last few years and hospitals now use a multitude of electronic health records platforms from different providers. As a result, the data contained inside each system is essentially walled off from the others.

Now, the $808 billion healthcare industry is faced with inefficiencies across clinician care, accounting, and IT. For example, Health Information Specialists alone are at risk of making errors because they must consult multiple systems to accurately gather information.

The lack of interoperability across these different systems is widely acknowledged. For this reason the Office of the National Coordinator for Health IT was tasked with the responsibility of advancing the connectivity and interoperability of health information technology.

Interoperability as defined by section 4003 of the 21st Century Cures Act includes the requirement that health information technology “(A) enables the secure exchange of electronic health information with, and use of electronic health information from, other health information technology without special effort on the part of the user; “.

This is a priority for the federal government since interoperability is expected to improve individual, community, and population health. According to the shared interoperability roadmap, the goal is to create a Learning Health System which reduces the time from evidence to practice while overcoming the obstacles of sharing health information across state lines due to differing state laws. I believe Clover Health has already found the mechanism for doing this through its Clover Assistant.

Clover Assistant

Like the Office of the National Coordinator for Health IT, Clover believes that leveraging the data it has access to as an insurer will help it improve its level of care by creating evidence-based protocols to standardize primary care physicians’ decision making.

Clover is in the process of achieving this through the Clover Assistant – a web application that uses machine learning to process the data from claims, medical charts, labs, pharmacy and electronic health records. Synthesizing this data, the Clover Assistant provides evidence from clinical rules, lab results, and machine learning to make recommendations for next steps. This helps physicians to quickly evaluate a patient’s medical history and provide care coordination at the point of care.

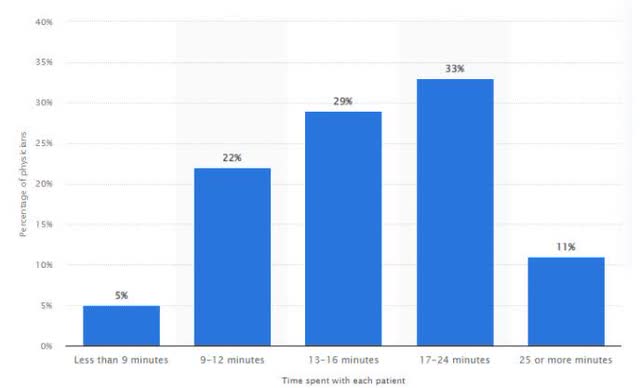

In this way, Clover is offering a solution to problems stemming from health information technology’s incompatibility. But what many investment analyses of Clover Health overlook is the urgency of this problem. According to the Association of American Medical Colleges, the US will experience a shortage of 37,800 to 124,000 physicians by 2034 as almost half of active physicians reach the age of retirement.

Rapid population growth and urbanization has already resulted in an abundance of patients per physician attributing to reductions in the amount of time spent with each patient. Therefore, in only 12 years the burdens caused by these inefficiencies will make Clover Assistant’s model incredibly useful.

Membership Growth

Clover Health has already reached November’s projection for over 200 thousand members by 2022 after reporting 257 thousand members in Q1 – an impressive 97% increase from the 129,996 members reported in Q4 2021. This above average growth is one reason I’m bullish on Clover’s Q2 earnings.

According to its guidance for 2022 Clover is expecting to average 84 to 85 thousand insurance members and 160 to 165 thousand Non-Insurance Beneficiaries. In line with this guidance, Clover has stated its intentions to offer its Medicare Advantage plans in 13 new counties across Georgia, South Carolina, and Tennessee. While Clover nearly doubled its counties for 2022, I am bullish on this expansion because of the market potential in these specific regions.

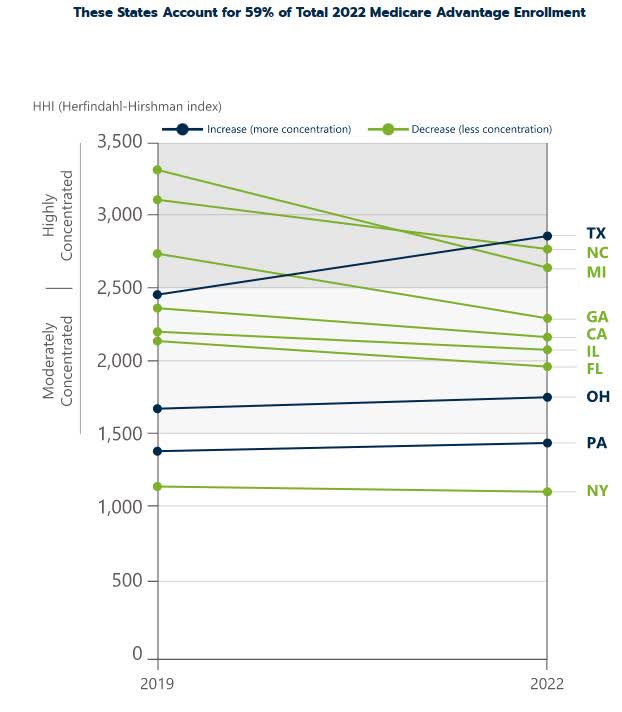

Clover’s expansion in Georgia is a positive sign since Clover reported a lower medical cost ratio (MCR) and member weight for this region compared to its other areas. Georgia and North Carolina are also two of the ten states contributing to 59% of the total 2022 Medicare Advantage Growth using the Herfindahl-Hirschman Index as a metric.

HHI Trend for the 10 States with the top 2022 Enrollment (The Chartis Group)

This shows that competition is improving in these states as for-profit plans lose some of their market share. In addition to that, Clover Health saw a 3 basis point increase in its national share for 2022 which is impressive considering that Humana saw a 37 basis point decrease.

At the same time, Clover is making the strategic decision to exit the counties of El Paso, Texas, and Pima, Arizona which will help concentrate its resources on growing its presence in markets where it is better established. These changes will be reflected in Clover’s 2023 membership after the annual enrollment period.

Medical Cost Ratio

I believe this will help reduce Clover’s MCR in the long-run since its growing presence in these existing markets will motivate more PCPs to adopt the Clover Assistant as more of their patients become Clover Health members. As this adoption takes place, the Clover Assistant will reduce Clover Health’s overall MCR.

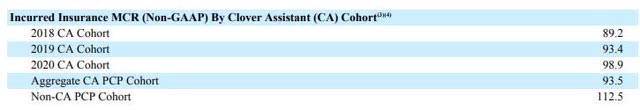

This is reflected in its incurred insurance MCR per cohort with those who adopted the Clover Assistant in 2018 reporting an MCR of 89.2. Overall, cohorts that have adopted the Clover Assistant have a notably lower MCR than its cohort for primary care physicians who do not use the Clover Assistant. Therefore, the longer that the members’ primary care providers use the Clover Assistant the more its MCR can be expected to improve.

This is critical to my long-term investment thesis since this ratio helps capture CLOV’s ability to achieve profitability by comparing its total medical expenses to its total insurance premiums. The goal is to have a lower MCR, but in 2021 the company reported an MCR of 106% – a drastic increase from 2020’s MCR of only 88%.

For comparison, in Q4 2021 United Health reported an MCR of 83.7% and Humana reported its own version (the benefits expense ratio) of 87.9%. Meanwhile, Clover reported an MCR of 96.7% for the same period. In Clover’s case the company essentially made a profit of only $.04 for every dollar spent on its members’ treatment for that quarter.

Clover is looking to improve its annual MCR which it expects to be in the range of 95% – 99% for 2022. I’m confident that Clover will be able to achieve its MCR target for the year since its expenses per member were increased due to Covid-19 costs.

But I believe that its expansion to these new counties will help drive an improvement in Clover’s MCR overall. While it’s important to note Bank of America’s criticism that Clover will not become profitable until 2024 at the earliest, this demonstrated improvement in its MCR per cohort is a sign that Clover’s model can become profitable.

Revenue Growth

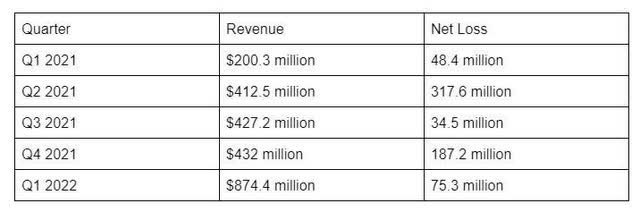

In the same vein, CLOV has reported consistent revenue growth QoQ despite a widening net loss. While an improving MCR will help tighten its net loss, I believe that CLOV will follow its Q1 revenue beat by reporting Q2 revenue in line or better than analyst’s current revenue projections. Its net loss should also see improvement this quarter based on the company’s guidance for 2022 which shows that Clover is working to significantly reduce its operating expenses.

Its guidance expects Non-GAAP adjusted operating expenses as a percentage of revenue of 10% to 12%. In 2021 operating expenses as a percentage of revenue was 18% therefore the company will be making changes quarter by quarter to meet this target.

Consensus EPS estimates are currently – $0.20 and the consensus revenue estimate is $805.32 million for CLOV’s Q2 results. In Q2 2021 Clover reported $412.5 million with only 129,000 lives under management. Since Clover doubled its total lives under management in Q1, the company is in a good position to meet revenue expectations.

As is, Clover will be releasing its Q2 results on Monday August 8th after market close. It’s worth noting that Clover has a strong shareholder base with retail investors holding 58.22% of the company’s stock and a beat of expectations could reinvigorate shareholders.

Valuation

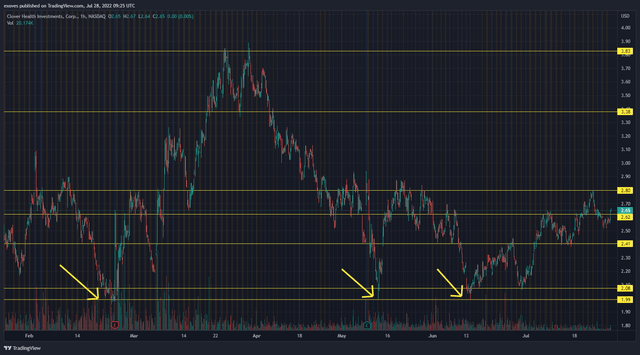

There are many reasons to be bullish on Clover now that costs related to the pandemic have subsided. I believe that Seeking Alpha’s Quant analysis of a $3.50 price target is reasonable based on my own technical analysis which shows the market consistently valuing the stock above $2.

CLOV has a strong support at $1.99 and although the stock has dipped to this level three times so far this year, each time buyers have come in triggering a strong rebound.

I believe that $2 is an accurate lower-end value for the stock since CLOV has total assets amounting to $2.6 billion which is more than its current market cap of $1.2 billion. But since this is a growth company, a more accurate indication of the value of CLOV’s shares would be its price to sales ratio.

In 2021, CLOV reported $1.47 billion in revenue and currently has a market cap of $1.2 billion. This gives it a P/S ratio of .81. In comparison, Alignment Healthcare, Inc. (ALHC) – trading at $14.62 per share – has a P/S ratio of 2.3 based on its $1.16 billion in revenue and market cap of $2.7 billion. Progyny Inc. (PGNY), a benefits management company specializing in fertility, is trading at $30.89 and has a P/S ratio of 5.67 based on its $500 million in revenue and $2.84 billion market cap. However, one of the leading healthcare providers – Molina Healthcare Inc. (MOH) – has a comparable P/S ratio to CLOV with revenues of $27.8 billion in 2021 and a market cap of $18.12 billion giving it a P/S of .65.

Based on this, CLOV has an attractive P/S ratio which shows that it already has a low valuation compared to other companies in its industry. This demonstrates that CLOV has a substantial upside potential if it continues its planned growth and supports my theory that the market is valuing CLOV shares above $2.

Risks

As is, my long-term investment thesis is based on Clover’s continued revenue and membership growth. If the company is unable to achieve its 2022 guidance then this would be a sign that its growth has potentially plateaued which would magnify many of the risks associated with Clover.

Despite CLOV’s low P/S ratio and consistent membership growth, Clover Health presents considerable risks. If the company is unable to control its widening net loss, then Clover will never achieve profitability regardless of the Clover Assistant’s merit.

Based on Bank of America’s projections, Clover will not become profitable until 2024 at the earliest. Until it achieves profitability, the risk of dilution will continue to threaten long-term shareholders and impact its future EPS. A recent, painful example of this was Clover’s jump from 420.6 shares outstanding to 472.2 million shares through a public offering in December 2021.

Additionally, Clover is an emerging growth company in a competitive market. Much larger competitors such as Humana and Centene are currently dominating the rapidly growing market for special needs plans which currently represents 31% of all enrollment growth in 2022.

Clover’s ability to capture adequate market share is also a very real concern since Humana Inc. saw a 27.85% increase in its national share of the market in 2022 while CVS Health/Aetna saw a 10.79% increase. This is substantially more than Clover Health’s 0.28% increase. Although the company offers its services across 9 states, beating out the competition it faces from more established players in these markets will continue to be an obstacle for the company.

In Clover’s case, the risk of not capturing more market share is even more potent since its business model relies on adoption of the Clover Assistant to generate the data needed to improve the system. Without this data, the Clover Assistant could fail to lower the company’s long-run MCR – putting it on a path towards continued unprofitability.

Conclusion

In conclusion, I believe CLOV is worthy of a long-term investment based on its healthcare technology asset and continued revenue and membership growth. My thesis is largely based on the value the Clover Assistant presents in the current healthcare technology landscape. Given that current studies indicate a strong need for interoperability between healthcare technology to relieve the already burdened healthcare system, I see Clover Health’s technology giving Clover Health an edge in the long-term.

For a better risk to reward ratio, investors could purchase shares closer to CLOV’s support at $2.08. But for those looking to play CLOV’s earnings in August, investors could add to their positions on pullbacks and trim at its $2.80 resistance.

If CLOV breaks its $1.99 support, I would look for a retest and a breakout beyond this level since historically there is a strong rebound from this point. If CLOV continues to drop this would be a warning sign for investors.

More Stories

Do you LOVE your dermatologist? Importance of Providers You Can Trust

Changing how Black Americans use life insurance could help shrink the racial wealth gap [Video]

Digital Innovation Spurs Seamless Healthcare Engagement