Table of Contents

Black Americans are more likely to carry life insurance than the average American, but their coverage does little more than provide for funeral costs.

Fifty-six percent of Black Americans have life insurance, according to a study by LIMRA and Life Happens, compared with 52% of all Americans. But 46% remain underinsured, with their benefits not enough to replace income or provide wealth transfer across generations.

But more coverage could help close the racial wealth gap, experts said, but many Black Americans are missing out because of financial concerns, a misunderstanding of how life insurance works, and mistrust of the industry at large.

“What I hear is, ‘My parents didn’t help me, so I’m just going to bury myself’…[leaving] every generation starting over, unlike other communities where they’re giving legacy to the next generation,” Wendy Edwards, a financial services professional with over 30 years of experience representing New York Life and other insurers, told Yahoo Money. “Instead, we have a financial loss and an emotional loss creating a recipe for disaster.”

![Changing how Black Americans use life insurance could help shrink the racial wealth gap [Video] Changing how Black Americans use life insurance could help shrink the racial wealth gap [Video]](https://s.yimg.com/ny/api/res/1.2/lPqnMbCwUWWdCuEx9wxWrw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyNDI7aD04Mjk-/https://s.yimg.com/uu/api/res/1.2/36_Y03_3Z5x.dFCPU9Mu9Q--~B/aD0zMzM3O3c9NTAwMDthcHBpZD15dGFjaHlvbg--/https://media.zenfs.com/en/aol_yahoo_money_602/946cde46bb4008e0db630af9cf47086e)

‘It’s simple math’

Just like insuring a car or home, life insurance protects an individual’s income potential, providing their family with a financial legacy if something happens to them.

The rule of thumb is to have 10 times your annual income in life insurance, according to insurance nonprofit Life Happens, to cover expenses beyond the funeral like housing, mortgage, childcare, health care, and education, so your family won’t be in debt.

Even if you only make $40,000 a year and work at least 35 years, your human capital would be $1.4 million. But many Black Americans aren’t accounting that way and therefore, pass along smaller windfalls to their heirs.

Only 10% of Black families receive a wealth transfer, versus 46% of white families, according to one 2014 study. The median transfer for Black families who get an inheritance is $52,240, or 60% less than the median transfer for white households.

“Is anybody educating our people that your human capital is worth millions?” Edwards said.

“It’s simple math,” Edwards added. “If you make $100,000 a year and work for 35 years, your human capital is worth $3.5 million. You pay a life insurance premium and automatically create an estate for that amount, whatever that amount is. But I am still getting calls about burial insurance.”

Financial concerns

One reason Black Americans may be underinsured is fewer resources.

The average income for Black households was $60,276 in 2020, according to the Census Bureau, compared with $86,770 for white Americans. Black workers historically are hit harder in recessions — including the latest during the pandemic — suffering disproportionate job losses and an unemployment rate that takes longer to recover.

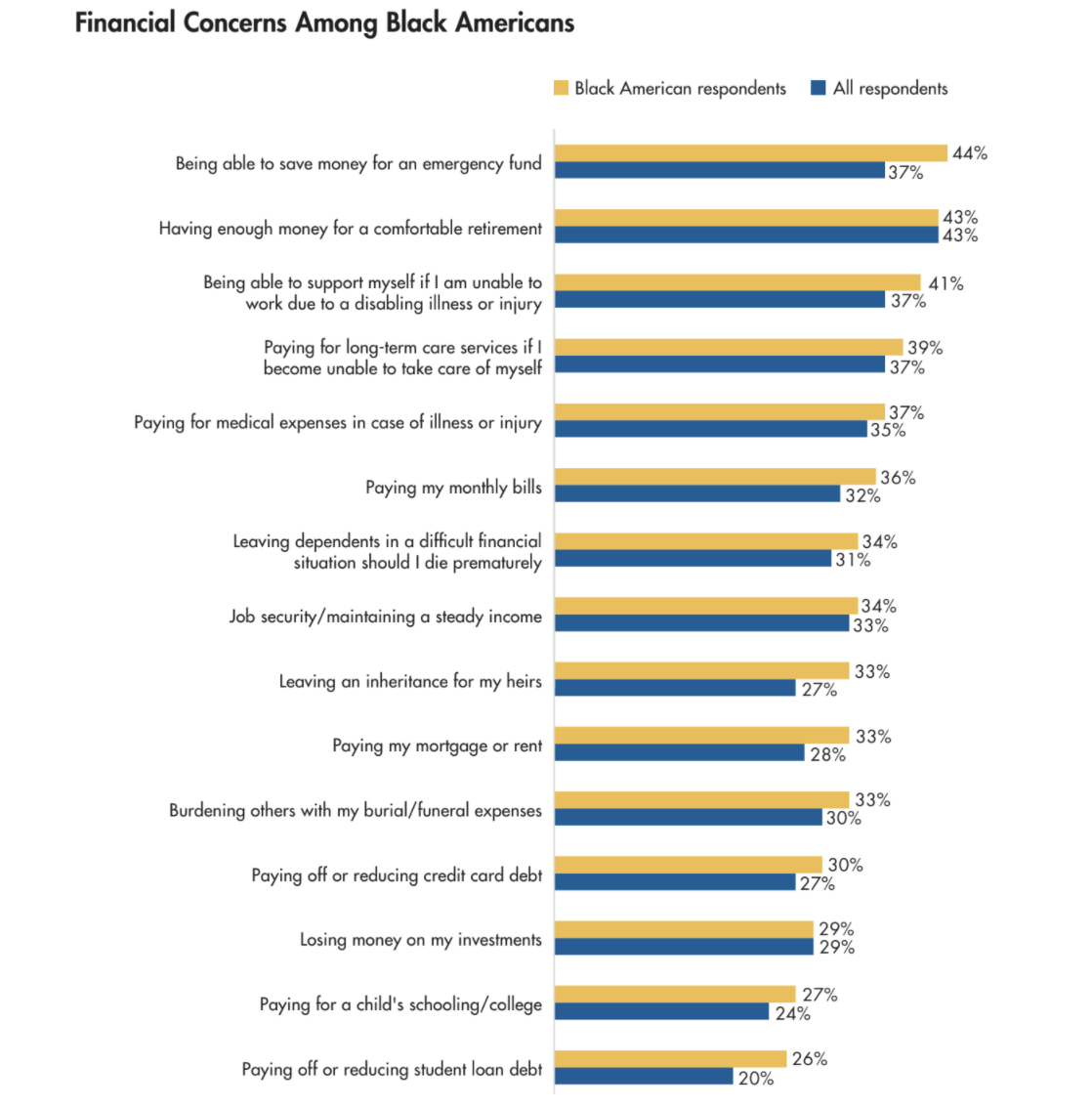

In a 2021 LIMRA study, Black Americans expressed these money worries and were more likely to report concerns about saving for an emergency, reducing student loan debt, and paying monthly bills than Americans overall.

“When you have enough savings so the ‘threat of survival’ is no longer apparent, you can afford to look further down the road to wealth creation and think about where you want to be 20 years from now,” Dr. Pamela Jolly, CEO and founder of Torch Enterprises, a strategic investment firm, told Yahoo Money. “Audacious goals and plans require a margin of safety so you can afford to take a risk; but if you can only afford to see a good meal, you can’t build a place of economic safety.”

‘A disservice to the Black community’

There’s also a long history of mistrust of financial institutions, including insurers, among Black Americans.

For instance, MetLife, John Hancock Life, and other life insurance companies in the early 2000s “settled multi-million dollar civil rights lawsuits involving race-based life insurance rates and benefits,” as outlined in the Northwestern Journal of Law and Social Policy’s “Ending Jim Crow Life Insurance Rates,” for the practice of charging Black Americans more for life insurance — marketed as burial insurance — that had little value compared to the premiums paid. This continued into the 1970s.

“The insurance industry and financial services did a disservice to the Black community,” Dr. Jolly said.

Just this year, the Casualty Actuarial Society also acknowledged “the potential impact of systemic racism on insurance underwriting, rating and claims practices” in its Methods for Quantifying Discriminatory Effects on Protected Classes in Insurance.

“So when I say you can’t have enough insurance and need at least a half-million policy, they view me as, ‘Oh, she just wants to make money off of me’,” Edwards said. “This is where you have a lack of trust.”

Understanding the ‘many benefits to a permanent life insurance’

Life insurance also can be complex for everyone with many different types of products with varied benefits and drawbacks. For example, you can outlive a term life insurance policy, while permanent life insurance policies have cash value in addition to death benefits that can be invested.

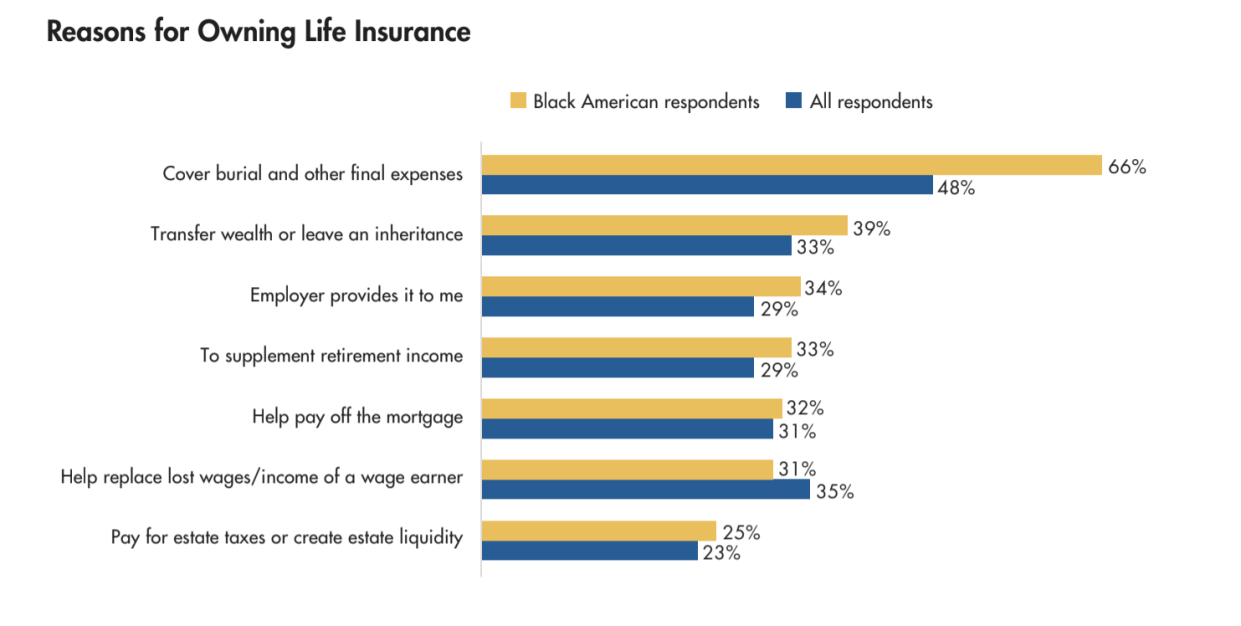

The LIMRA study found that 68% of Black Americans who have individual life insurance have permanent life insurance with the intent of using the cash value for burial and final expense costs. But that use is missing other ways the cash value can be utilized to help build wealth.

“One of the greatest benefits of permanent life insurance is the ability to accumulate cash value that grows tax deferred,” Mark Williams, CEO of Brokers International, told Yahoo Money, “and can be accessed in the form of loans, withdrawals, or surrender for the life of the policy,”

Cash value can be used as a retirement savings vehicle or to fund a business, college education, or purchase a home — all ways to create wealth.

“There’s so many benefits to a permanent life insurance policy,” Edwards said. “I got a call from a client who said, ‘Wendy, I’m short on paying the tuition for the kids.’ Okay, I’m going to send you $10,000 from your policy. Another client called and said they were short on closing costs for their home. They didn’t realize they could use the cash value from their permanent life insurance to fund these things.”

Wealth building

“It takes three generations to build legacy wealth, one generation to lose it, and four generations to solidify,” Dr. Jolly’s research into barriers to wealth generation in the Black community showed.

Outside of home ownership, life insurance is one of the most common avenues for wealth creation — if utilized correctly. There is no one size fits all. It’s also just as important for heirs to think of the future when they benefit from a life insurance windfall to build a legacy of wealth.

“Early in my career, a client struggled to pay premiums. When she died, her son bought a Maxima with the insurance proceeds and drove it off the road the following week. I was so angry,” Edwards said. “Now I see beneficiaries asking how to invest the proceeds and starting their own businesses from the life insurance proceeds.”

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Money.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn

More Stories

Do you LOVE your dermatologist? Importance of Providers You Can Trust

Digital Innovation Spurs Seamless Healthcare Engagement

Why Calvin Klein’s ad depicting a trans family is causing a stir