Table of Contents

Chadchai Krisadapong/iStock by means of Getty Visuals

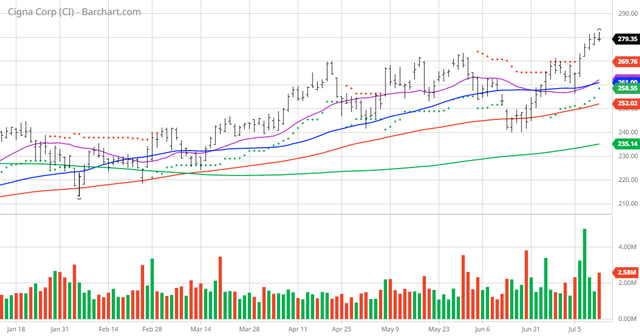

The Chart of the Working day belongs to the healthcare organization Cigna (CI). I discovered the stock by sorting Barchart’s Leading Shares to Have record 1st by the most regular quantity of new highs in the final month, then used the Flipchart attribute to overview the charts for steady cost appreciation. Considering the fact that the Development Spotter signaled a obtain on 7/6 the inventory attained 3.05%.

CI vs Day-to-day Relocating Averages

Cigna Company gives insurance policy and associated solutions and services in the United States. Its Evernorth phase provides a array of coordinated and issue resolution wellbeing providers, like pharmacy, benefits management, treatment supply and administration, and intelligence alternatives to health strategies, businesses, govt organizations, and wellbeing treatment vendors. The firm’s Cigna Health care phase provides health care, pharmacy, behavioral wellness, dental, eyesight, wellbeing advocacy packages, and other merchandise and services for insured and self-insured prospects Medicare Benefit, Medicare Complement, and Medicare Aspect D ideas for seniors, as nicely as specific health insurance policy plans to on and off the general public exchanges and health treatment coverage in its intercontinental marketplaces, as properly as health and fitness treatment benefits for mobile people today and workforce of multinational corporations. The enterprise also delivers lasting insurance plan contracts sold to corporations to deliver protection on the life of selected workforce for funding employer-paid out potential reward obligations. It distributes its solutions and providers as a result of insurance policies brokers and consultants instantly to companies, unions and other groups, or persons and private and public exchanges. The organization was founded in 1792 and is headquartered in Bloomfield, Connecticut.

Barchart’s View Trading programs are detailed beneath. You should notice that the Barchart View indicators are up to date reside in the course of the session each individual 20 minutes and can therefore transform in the course of the working day as the marketplace fluctuates. The indicator quantities demonstrated down below thus may not match what you see are living on the Barchart.com web-site when you browse this report.

Barchart Technological Indicators:

- 100% technical get indicators but rising

- 27.39+ Weighted Alpha

- 18.76% get in the last year

- Pattern Spotter get sign

- Previously mentioned its 20, 50 and 100 day transferring averages

- 13 new highs and up 10.29% in the final thirty day period

- Relative Toughness Index 65.63%

- Technical guidance stage at $277.70

- Just lately traded at $279.35 with 50-day relocating regular of $261.00

Basic aspects:

- Market place Cap $88.81 billion

- P/E 12.84

- Dividend yield 1.60%

- Earnings predicted to expand 2.60% this 12 months and a further 4.80% future 12 months

- Earnings estimated enhance 11.00% this yr, an more 11.10% subsequent yr and to carry on to compound at an annual level of 11.45% for the upcoming 5 many years

Analysts and Investor Sentiment – I really don’t invest in stocks for the reason that absolutely everyone else is buying but I do comprehend that if big corporations and buyers are dumping a stock it can be tricky to make revenue swimming towards the tide:

- Wall Avenue analysts have 10 solid invest in, 5 invest in and 9 maintain opinions on the inventory

- Analysts give an common value concentrate on at $296.09 with some analysts predicting as higher as $330.00

- The unique traders next the inventory on Motley Idiot voted 374 to 44 for the stock to beat the sector with the extra expert investors voting 86 to 4 for the identical end result

- 31,710 buyers are monitoring the stock on In search of Alpha

Scores Summary

Aspect Grades

Quant Rating

Sector

Field

Well being Care Products and services

Rated Overall

Ranked in Sector

Ranked in Business

Quant scores beat the marketplace »

Dividend Grades

:max_bytes(150000):strip_icc()/GettyImages-173808071-589cdc493df78c47585c6343.jpg)

More Stories

‘Unretiring’? This is how to handle your Medicare coverage

6 Hacks to Build More Sustainable Habits

Red cheeks – what can you do?